National Cyber Practice Leader

- Cambridge, MD

The insurance industry has often been accused of having a short memory. Perhaps in no other sector are market cycles predicted with more certainty. Yet the very factors that take us into challenging markets are often followed by periods of amnesia, leaving agents, brokers and insureds scratching their heads.

Case in point: The years were 2020 to 2022. The rise of ransomware, coupled with an environment of poor security controls, contributed to a rash of Cyber insurance claims that forced a hard and fast market correction. Loss ratios had quickly deteriorated, and something had to be done. Insurers dramatically increased rates, reduced limits, increased retentions and required more stringent IT protections — like multi-factor authentication (MFA) — to help shore up the vulnerabilities that led to ransomware attacks.

As a result, ransomware frequency dropped, and profitability returned to the fastest-growing sector in insurance. Certainly, other important factors such as the war in Ukraine, a fully remote workforce returning to the office, and higher government and law enforcement focus contributed to these improved results as well. However, the most significant levers of rate, exposure and barriers to entry were pulled with great force.

So, what does every new insurance market cycle do in the face of prosperity? Naturally, the opposite of what got us there to begin with. So far in Q2 2023, we're seeing great disparities among insurers as they seek growth without the benefit of rapidly rising renewal rates. Among the strategies currently employed are:

Having said that, it's important to note that carriers aren't employing these strategies consistently, making this "maturing" market all the more unpredictable.

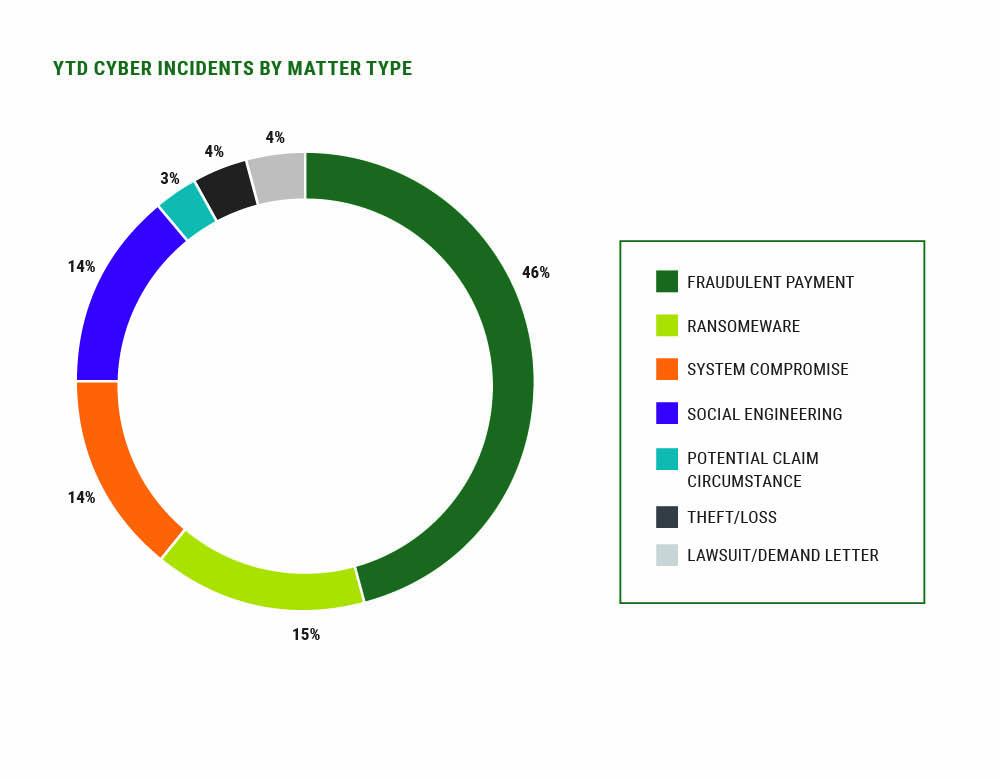

In our last quarterly cyber market update, we discussed the decrease in ransomware frequency and how fraudulent payments had taken over the top position in claims frequency. While this trend still holds in Q2, it's not to say that ransomware has gone away. What we are seeing is a significant drop in an organization's willingness to pay. Forensic and cyber extortion incident response firm Coveware reports a dramatic drop, showing that 85% of ransomware victims paid the ransom in Q1 of 2019 vs 37% in Q4 of 2020.1

RPS has observed similar trends on our own book, but from an insurance perspective. And even with this drop in propensity to pay, significant costs of forensics, data restoration, legal advice and business interruption costs persist. These factors make every ransomware attack, regardless of whether the threat actor is paid, an extremely taxing event causing significant financial, operational and reputational impacts to those affected.

We've noticed, and corroborated with several insurers in the past 30 days, a noted increase in ransomware activity in April. After a very light February, and a slight increase in March, it's still too early to tell if this is a trend that will continue. However, a variant known as Royal has shown significantly increased persistence. These threat actors focus primarily on critical infrastructure sectors including Manufacturing, Communications, Healthcare and Public Healthcare, and Education, according to the Cybersecurity Infrastructure & Security Agency (CISA).2

Recently, one of our insureds experienced a Royal ransomware attack and was left with no option other than to pay, as its backups were unknowingly housed in the same environment as the primary network.

Just last week, a law enforcement agency became the most recent victim of Royal, forced to respond to an initial demand of nearly $2 million. Its cloud backups weren't secured. Unlike the insured mentioned above that will suffer operational disruption and inconvenience, the impact on law enforcement or healthcare organizations can carry life-threatening consequences. In this case, officers in the field cannot communicate with dispatchers at headquarters.

The CISA's Cybersecurity Advisory suggests the following high-level actions for mitigating cyber threats from ransomware: 2

From a recovery perspective, regular backups of an insured's critical data are among the most important steps to avoid paying a ransom. The backups should be completely isolated from the network, either stored offsite and encrypted or stored in the cloud with separate access credentials. If backups are remote, use MFA e to protect access and test backups regularly to ensure their efficacy.

As state and federal privacy laws continue to expand their scope, and as the confluence of technology, media and advertising become more intertwined in organizations' daily operations, we're witnessing a significant impact on third-party privacy claims.

Remember that part of a Cyber insurance policy that you don't pay a lot of attention to, because your insureds mainly want the "red phone" to respond to their information security emergencies? Now, you're more likely to see the liability side of the policy triggered than ever before, and insurers are taking measures to limit their exposure to these lower-frequency, higher-severity claims on their books.

Leading the way in third-party liability claims this quarter are incidents involving the unauthorized collection of web data, specifically using website trackers, pixels and cookies. Lokker, a business intelligence software and big data analytics platform, summarizes the "why" of this new phenomenon quite well in a recent report:

"According to HTTP Archive's latest Annual State of the Web Report (Sep. 2022), 94% of sites use at least one third party, and, on average, the top 1,000 websites use 53 third-party scripts including ads, analytics, CDNs, chatbots, video delivery services, content providers and social media features. Introducing all this activity into millions of browser sessions has become mayhem for unauthorized data collection, theft and exploitation. Thus, the customer's web browser is now a hotbed of cyber risk, exposing visitors to malware, theft of their private information and violations of privacy laws."3

What does this mean from a Cyber insurance perspective? Insurers are taking swift action to avoid costly privacy litigation claims in their policy wordings. Many carriers are relying on broad "unauthorized collection and use" exclusions in their policies to avoid paying defense costs and indemnity for claims of this nature. Some are applying sublimits, while others are increasingly introducing specific pixel tracking exclusions, particularly in the healthcare space (for example, a hospital patient portal collects data and shares it with a social media platform in an effort to target patients for medical devices, medications or other services that could directly treat the patient's condition).

Data suggests that merely incorporating the use of such tools in an organization's privacy policy online isn't sufficient. We expect these lawsuits to continue expanding among organizations in varying industries, including retail and hospitality.

Insurers are increasingly using URL scanning technologies and additional questionnaires to underwrite around this risk. Agents and brokers should familiarize themselves with this trend and search policy forms and endorsements for exclusions relative to wrongful or unauthorized collection, pixel tracking and similar wordings. Advise your insureds of their potential exposure in this area, and today's Cyber insurance policies likely won't cover claims of this nature. You can point them to resources that can help them assess their risk, such as free web-based pixel scanning technologies like Blacklight.4 Cyber insurer Beazley suggests the following as a start:5

Chronologically speaking, the big shift in Cyber insurance underwriting occurred roughly two years ago. It was then that acronyms such as MFA, EDR, SEG and IRP found their way into the daily vernacular of cyber specialty underwriters and brokers. This increasingly technical view of risk left many retail insurance agents confused at best, not to mention the small businesses they insured.

Particularly in the SME sector — where businesses often lacked sophisticated in-house IT resources — the prospect of completing an application for Cyber insurance became daunting. Facing a firming market with much higher barriers to entry, their answers in Cyber insurance applications often didn't reflect the true view of risk in insureds' IT systems. Likely more often unintentional than deliberate, the inaccuracies were now in the insurance underwriting ecosystem, and only the future would tell the impact this could have.

Fast-forward to today. As organizations experience the usual cyber-related incidents that affect everyone, insurers and brokers are increasingly finding themselves in uncomfortable conversations when adjudicating claims for their clients. When the fact patterns of a claim don't jive with what was represented on an application, the disconnect can potentially lead to claim denials — not a spot anyone wants to be in. While misrepresentation has been a factor to deal with since the very origins of insurance, the highly technical nature of cyber underwriting has created an environment where the risk is now much higher. The fact is, many of the scanning technologies insurers use today can't assess some of the more important technologies insurers require for Cyber insurance eligibility. As a result, they still rely on accurate information in paper applications.

We expect two trends to gain traction in the current effort to more effectively underwrite cyber risk, avoiding the aforementioned conflicts.

The short story here is this: Insurers are less interested in using their funds as the sole risk transfer tool for small businesses. For coverage to apply, insurers will increasingly require at least the most basic prevention measures to be in place. Wanting to avoid bad faith claims at all costs, insurers may wish to more frequently incorporate these requirements into the policy language itself. By not merely relying on accurate answers in applications — and leaving the nuances of the absence of words like "any" and "all" to dictate coverage applicability — insurers will begin to feel more comfortable that their coverage offerings are in line with their risk assessments.

Time will tell how often, and to what extent, insurers will incorporate strategies like digital validation and condition precedent policy wording to reduce their risk. One thing is for sure, the old phrase "trust but verify" will describe cyber underwriting in the future. Agents and brokers are wise to closely review Cyber insurance applications with their customers before submitting them to brokers and insurers. As these applications become more nuanced, so too can the impact of their answers on coverage in the policies. Make all best attempts to verify the accuracy of these answers before a conflict arises.

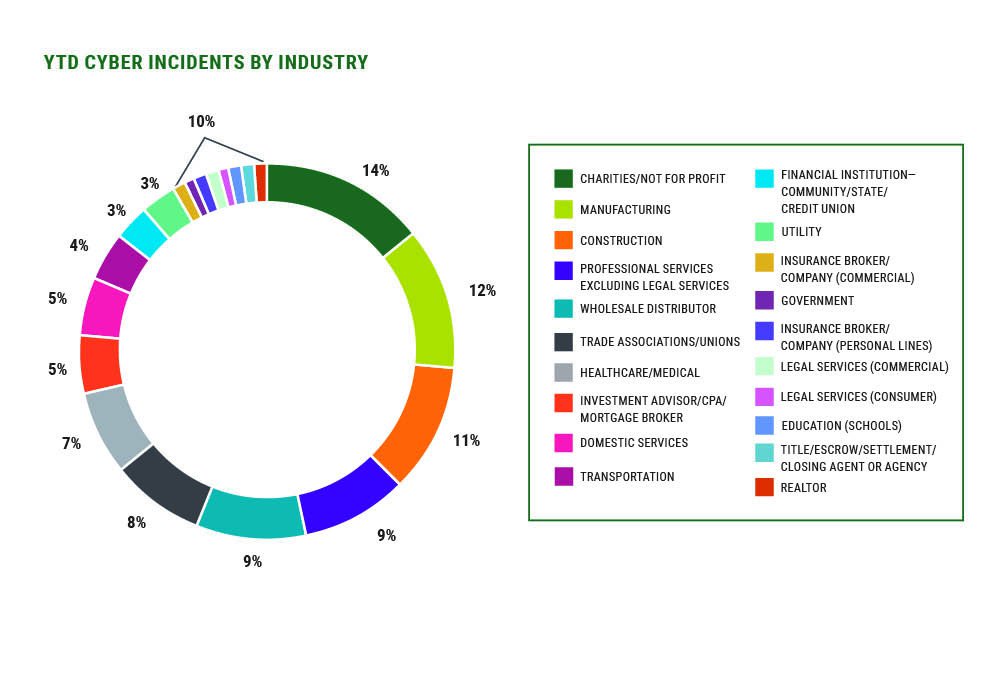

In our last state of the market report, we began sharing RPS-specific claims data on our insureds, particularly in the SME sector. Using the data on thousands of Cyber insurance clients and more than 1,000 claims, not only can we tell that ransomware claims still occur, we can tell you that they've been experienced most in Charities/Non-Profits, Manufacturing, Construction, Wholesale Distribution, Government and Healthcare.

We observe that, for instance, more incidents occur in March than May, and that Healthcare experiences their biggest spikes in the month of September. The average ransom demand among our SME clients in March was just over $300,000 and the average paid (among those who did pay) was $192,000. The average fraudulent payment trended lower in March at $35,000. Having real-time, actionable data like this allows RPS to more accurately structure the most appropriate Cyber insurance programs for our retail agents and our mutual clients.

Here are some updates on the claims front after the first three months of 2023, based on Information derived from proprietary RPS claims data among SME insureds with less than $100 million annual revenue.

While March saw an uptick in new matters versus February, claims volume remains slower, relative to historic norms, and industry types affected by claims were more evenly spread, with no one industry dominating.

There continues to be movement among states to expand laws protecting consumer privacy. In our last report, we touched on the state laws in various stages of change in California, Colorado, Connecticut, Utah and Virginia. In addition, some existing federal laws are expanding, such as the protections afforded under Gramm-Leach-Bliley and new requirements for financial institutions to protect the security of customer information. These requirements don't stop with the traditional view of financial institutions, but extend to peripheral entities that act in similar capacities — such as car dealerships — where the collection of sensitive financial and personal data is extensive.

To underscore points made earlier about inconsistencies among carrier approaches to Cyber insurance and a distribution system that's confused by the rules, in February, US Senators John Hickenlooper and Shelley Moore Capito introduced the Insure Cybersecurity Act. This bipartisan legislation aims "to protect consumers and small businesses against cyberattacks by providing clearer information surrounding Cyber insurance policies." The bill aims to create a "dedicated working group to develop recommendations for issuers, agents, brokers and customers to improve communication over cybersecurity insurance coverage levels."6

Since Lloyd's introduced its model clauses for cyber war and cyber operation exclusions in November of 2021, much development has taken place in this area — both among Lloyd's syndicates and domestic US insurers.7 While their approaches differ, one thing is certain: Cyber insurance policies were never intended to cover, nor were they priced for, cyber events in conjunction with a physical war that has a wide lateral affect, felt by a significant population.

The problem is that these new exclusions can show themselves in two basic forms:

It's important that agents read the fine print and understand the potential impact to their insureds who have concerns about how these unlikely, yet devastating, events could affect their coverage.

In an industry experiencing such a rapid rate of change, it's important for agents and brokers to be closer to their clients than ever. For Cyber insurance, it's likely that your renewal conversations will be much more pleasant than the ones you had this time last year. With a more stable market and Excess Liability coverage now offered at a significant value, you should be discussing higher limits where warranted.

If you're unsure what constitutes "warranted," we recommend consulting a broker who specializes in Cyber insurance. Also, as more insurers get in the game after two years on the sidelines, beware of unsolicited Cyber insurance quotes that might accompany ancillary lines on your renewals. Without close review, you may find that their new approach to the market could include significant coverage restrictions compared to markets who have weathered the storm.

With broad market representation and tens of thousands of Cyber insurance customers in all 50 US states, RPS stands ready to assist you and your clients for what's possible.

For more information, plan to attend our first quarterly Cyber market update webinar on Thursday, May 18. We'll have a bit of fun by introducing real situations our Cyber practice group has encountered this quarter. It will be your job to figure out which ones aren't real. These recent scenarios certainly prove that insurance is anything but boring.

1"Improved Security and Backups Result in Record Low Number of Ransomware Payments," Coveware, 19 Jan 2023.

2"#StopRansomware: Royal Ransomware,"Cybersecurity Infrastructure & Security Administration, 2 Mar 2023.

3Fisher, Kaitlyn. "Online Data Privacy Report — March 2023," Lokker, 7 Mar 2023.

4Mattu, Surya. "Blacklight," The Markup, accessed 24 Apr 2023.

5Heaton, Katherine. "Cyber Risk Revealed: Pixels and Tracking Technology," Beazley, 14 Dec 2022.

6"Hickenlooper, Capito Introduce Bill to Help Better Insure Small Businesses Against Cyber Attacks," US Senator John Hickenlooper, 21 Feb 2023.

7"Cyber War and Cyber Operation Exclusion Clauses," Lloyd's Market Association, 25 Nov 2021.